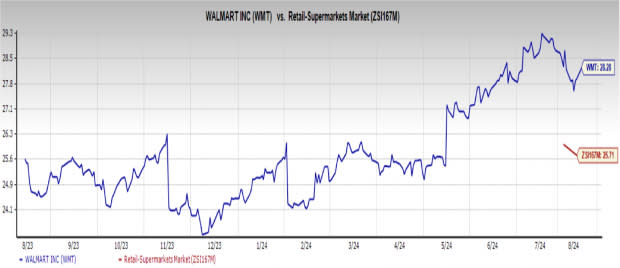

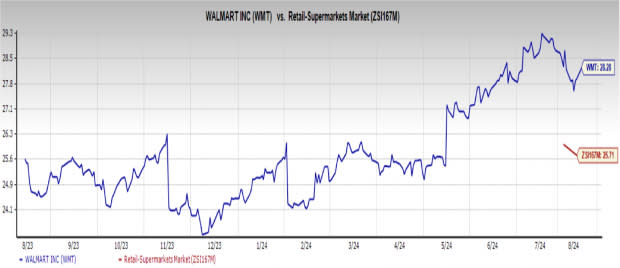

This year was impressive for Walmart Inc. WMT shares have risen 30.7% year-to-date, slightly more than the retail and supermarket sector’s 28.3% gain. Shares of major retailers actually broke through their resistance levels in mid-May and have been on a sustained upward trajectory.

Image source: Zacks Investment Research

Additionally, Walmart’s share price closed at $68.70 on August 12, just above its 50-day moving average (DMA) of $68.43, indicating further positive uptrend in the short to medium term.

Image source: Zacks Investment Research

What’s behind Walmart’s upward trend?

Walmart’s shares have risen largely due to the company’s investments in artificial intelligence (AI), which has the potential to increase profit margins by streamlining operations. The investments in automation, such as an automated shopping cart inspection system and an autonomous forklift manufacturer, are expected to boost Walmart’s earnings before interest and taxes (EBIT) over the long term.

Walmart’s e-commerce and advertising business continue to be growth drivers. Walmart optimized its online sales platform by allowing third-party sellers to advertise their products. Such an incredible move has helped Walmart improve its online sales recently. Walmart successfully penetrated the ever-growing e-commerce market where Amazon.com, Inc. AMZN is already a tough competitor.

Walmart’s introduction of Best Buy Co., Inc.The BBY ship-from-store model has already helped the retail giant’s e-commerce business reach $100 billion in annual sales in 2023. At the same time, Walmart’s advertising business is thriving, posting a compound annual growth rate of 27.2% over the past three years. In fact, Walmart’s advertising business grew in the first fiscal quarter of 2024 thanks to its acquisition of smart TV maker Vizio for $2.3 billion.

Unlike competing retailers Target company TGT, Walmart’s store sales rose in the fiscal first quarter, driving up the company’s revenue and stock price. Store sales rose as Walmart stores offered more everyday consumer goods while Target sold less in-demand goods such as clothing.

Positive Q2 results cause WMT share price to rise further

Walmart’s successful promotion of its subscription programs and continued strong sales at its retail stores over the past few months should certainly help the company deliver encouraging results for its second fiscal quarter, which are scheduled to be announced before the market opens on August 15.

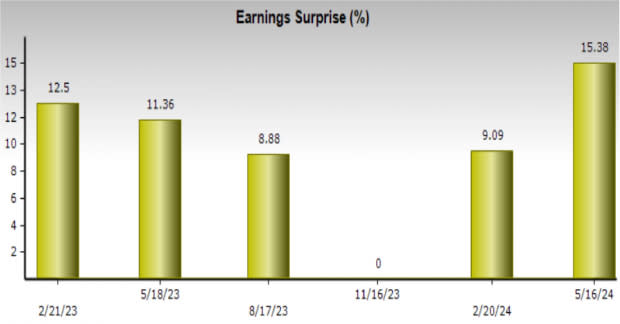

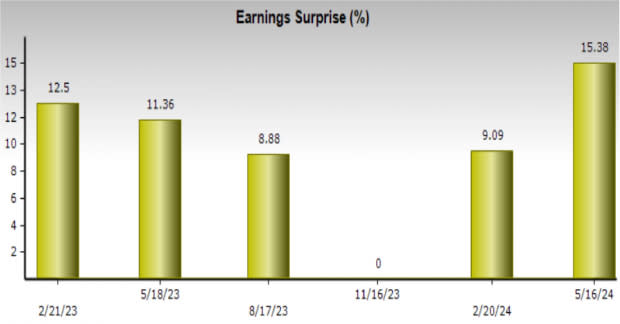

Walmart will report earnings per share of 65 cents for the fiscal second quarter, up from 61 cents a year ago, representing an increase of nearly 6.6%. In addition, Walmart has posted an average positive earnings surprise of 8.3% over the past four quarters, a clear sign that the stock has a good chance of showing excellent earnings growth in the upcoming earnings announcement, which will lead to an uptick in the share price.

Image source: Zacks Investment Research

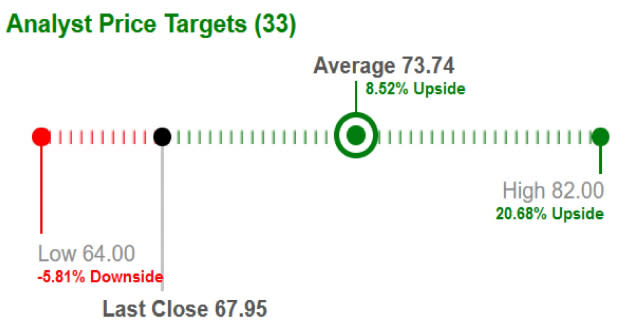

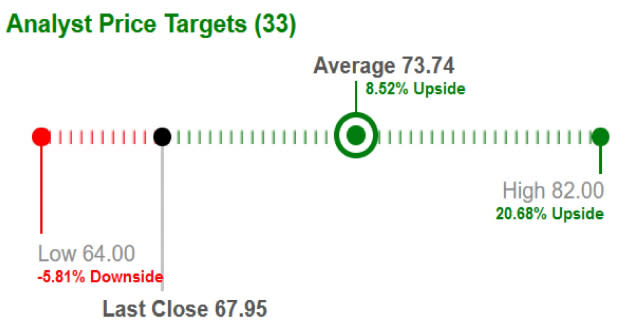

For this reason, major brokerages have raised the average short-term price target for WMT by 8.5% from the retailer’s last closing price of $67.95. Analysts have set the highest price target at $82.

Image source: Zacks Investment Research

Walmart valuation expensive, but indicates growth

Walmart stock is undeniably expensive right now. Looking at the price-to-earnings ratio, Walmart stock is currently trading at 28.2 times forward earnings. However, the retail supermarket forward earnings multiple is 25.7.

Image source: Zacks Investment Research

However, this certainly indicates that market participants believe that Walmart stock will be able to generate higher profits sooner or later, which in turn will lead to an increase in demand and price.

Walmart – a tempting purchase

Since Walmart’s share price is on an upward trend, it is advisable for smart investors to bet on the stock to earn substantial returns. The company has already been able to generate good profits as WMT has a return on equity (ROE) of 21.6%. Any ROE above 20% is usually considered very strong.

The Zacks Consensus Estimate for WMT’s current-year earnings has increased nearly 3% over the past 90 days. The company’s expected earnings growth rate for the current year is 9.5%. Therefore, WMT rightly has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Download the 7 best stocks for the next 30 days today. Click here to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research