Second-quarter results from major retailers will continue to highlight this week’s earnings roundup with Walmart WMT The Q2 report is scheduled to be released on Thursday, August 15th.

It is particularly noteworthy that Walmart’s Zacks Retail-Supermarkets Industry is currently in the top 11% of about 250 Zacks Industries. As a key beneficiary of its strong business environment, Walmart’s stock currently sports a Zacks Rank #2 (Buy), and now seems like an ideal time to invest in the omnichannel giant.

Walmart’s expectations for the second quarter

Zacks estimates that Walmart’s second-quarter revenue is expected to have increased 4% to $168.5 billion. On the bottom line, second-quarter earnings are expected to increase 6% to $0.65 per share, compared to earnings per share of $0.61 in the comparable quarter.

Walmart attributes its recent rebound to higher sales, which have led to market share gains, including in general merchandise sales. To date, Walmart has beaten sales estimates for 17 consecutive quarters and beat earnings expectations in three of its last four quarterly reports, with the company posting an average EPS surprise of 8.34%.

Image source: Zacks Investment Research

Performance comparison

Walmart’s notorious price cuts continued to attract customers despite still-higher inflation, giving the company an edge over competitors like Target TGT. and Kroger KR.

This price leadership is reflected in the fact that Walmart shares have risen by almost 30% since the beginning of the year, impressively outperforming Kroger’s +12% and Target’s -5%.

Image source: Zacks Investment Research

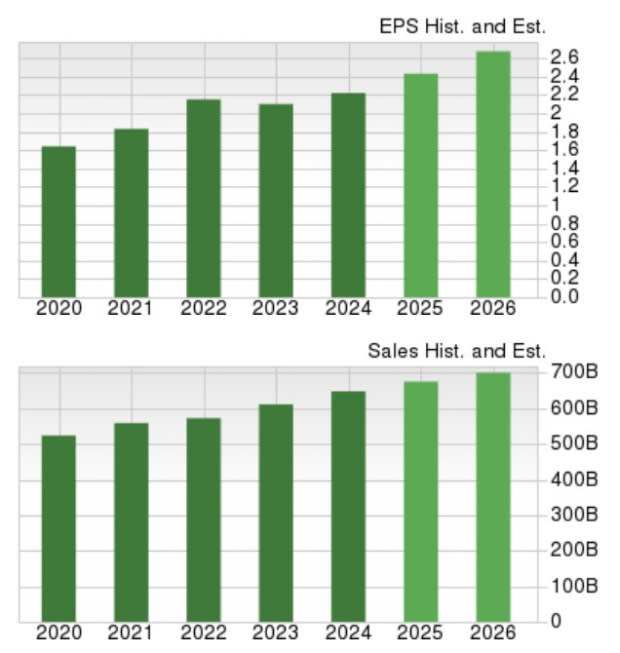

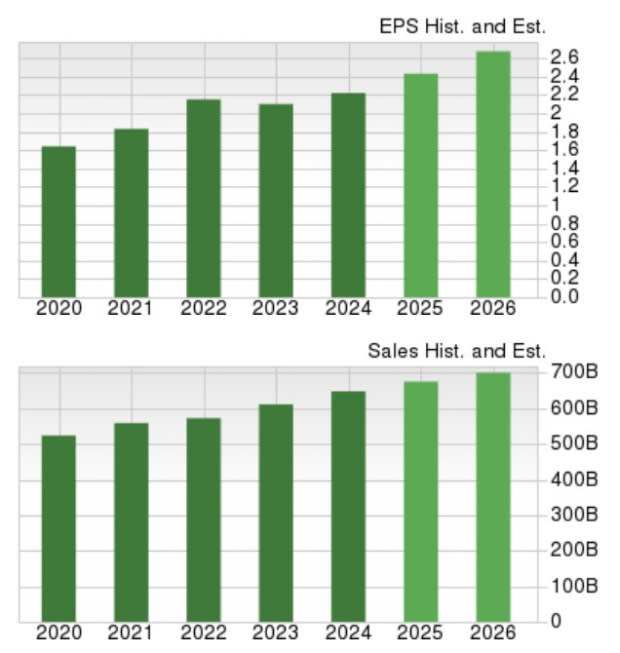

Attractive growth trend

Overall, Walmart’s total revenue is forecast to increase 4% in the current fiscal year 2025 and another 3% to $700.3 billion in fiscal year 2026. Even better, annual earnings are forecast to increase 9% in fiscal year 2025 and another 10% to $2.67 per share in fiscal year 2026.

Image source: Zacks Investment Research

Conclusion

Walmart’s dominance among supermarket chains has become undeniable in recent years, and WMT’s rise could continue as the company is expected to post solid growth in the second quarter. Therefore, it’s notable that the Zacks average price target of $73.74 still suggests 7% upside potential for Walmart stock.

Want the latest recommendations from Zacks Investment Research? Download the 7 best stocks for the next 30 days today. Click here to get this free report

Walmart Inc. (WMT): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

The Kroger Co. (KR): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research