ONE Gas, Inc. (NYSE:OGS) shareholders may be pleased to see that the stock price rose 17% in the last quarter. But that doesn’t change the fact that returns over the past five years have been anything but encouraging. In fact, the stock price has fallen 26%, which is far below the return one could get by buying an index fund.

So let’s see if the company’s long-term performance is consistent with its underlying business performance.

Check out our latest analysis for ONE Gas

To paraphrase Benjamin Graham, in the short term, the market is a voting machine, but in the long term, it is a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a sense of how investors’ attitudes toward a company have changed over time.

During the unfortunate half-decade that saw its share price fall, ONE Gas actually managed to grow its earnings per share (EPS) by 3.0% per year. So EPS doesn’t seem to be a good guide to how the market values the stock. Alternatively, growth expectations may have been unreasonable in the past.

Looking at these numbers, we would assume that the market was expecting much higher growth five years ago. A look at other metrics might better explain the price change.

Unlike the share price, revenue has actually grown 11% per year over this five-year period. So it seems that one needs to look more closely at the fundamentals to understand why the share price is weakening. After all, there could be an opportunity here.

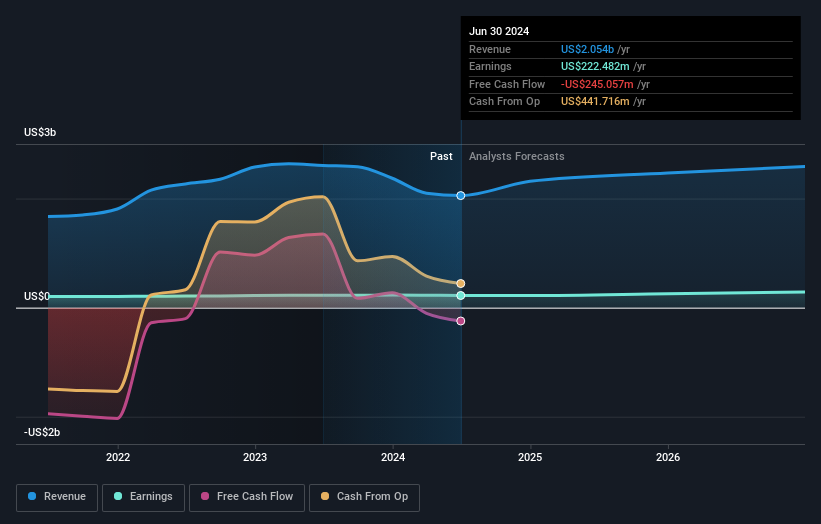

The company’s revenue and profit (over time) are shown in the image below (click to see the exact numbers).

A strong balance sheet is crucial. It might be worth taking a look at our free Report on how his financial situation has changed over time.

What about dividends?

In addition to measuring the share price return, investors should also consider the total shareholder return (TSR). While the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It could be argued that the TSR gives a more comprehensive picture of the return generated by a stock. In fact, ONE Gas’s TSR over the last 5 years was -12%, which exceeds the share price return mentioned earlier. Thus, the dividends paid by the company have in total shareholder return.

A different perspective

It’s been a rough year for ONE Gas investors, with a total loss of 4.0% (including dividends) against a market gain of about 25%. Even good stocks’ share prices fall sometimes, but we like to see improvements in a company’s fundamental metrics before getting too interested. Unfortunately, last year’s performance capped a bad streak, and shareholders have suffered a total loss of 2% per year over five years. Generally speaking, long-term share price weakness can be a bad sign, although contrarian investors should research the stock in hopes of a turnaround. While it’s worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We’ve noted 3 Warning Signs for ONE Gas You should be aware of this, and one of them makes us a little uncomfortable.

If you are like me, you will not don’t want to miss this free List of undervalued small caps that are being bought by insiders.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks currently trading on U.S. exchanges.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.