Southwest Airlines (LUV) issued a memo in recent days advising employees that “difficult decisions” lie ahead as the company tries to restore its lost profitability. Investors welcomed these difficult decisions, sending shares slightly higher on Monday afternoon.

While admittedly no one has actually used the L-word, Southwest has already visibly taken steps that would increase its profitability. For example, the company plans to return to assigned seating rather than letting people sit wherever they want, it also plans to resume overnight flights, and it is trying to sell seats with more legroom. These are not necessarily bad moves, and could well help it achieve that profit.

None of these decisions are “difficult,” however, and with Elliott Investment Management already putting pressure on the company, layoffs could be the quickest way to achieve short-term gains. It’s possible that Southwest’s series of small changes will effectively stretch into profitability, but there are still plans for Southwest to scale back its presence in some cities while making staff changes. These may not necessarily be layoffs, but consolidation and uprooted families are on the horizon.

Falling demand

Anyone who has shopped for groceries in the last year or so already knows that inflation has a stranglehold on the U.S. economy, and it’s far from alone on that front. Unsurprisingly, it’s also leading to a drop in travel demand. One report by traveler Robert Pizzarello states that on a United (UAL) flight from Las Vegas to Washington-Dulles, there were “…about 30 empty seats…” That’s not something Pizzarello has heard often, but it seems to be the case on more and more flights.

As consumers congregate and protect their wallets — let’s not forget the Lending Tree study in late May that found that 78% of Americans surveyed call fast food a luxury — travel is likely to take a hit. That will put Southwest in trouble, as its numerous small changes may not be enough in the face of falling demand. More flights are great, but if no one wants to buy a ticket, they have limited value.

Should you buy or keep LUV shares?

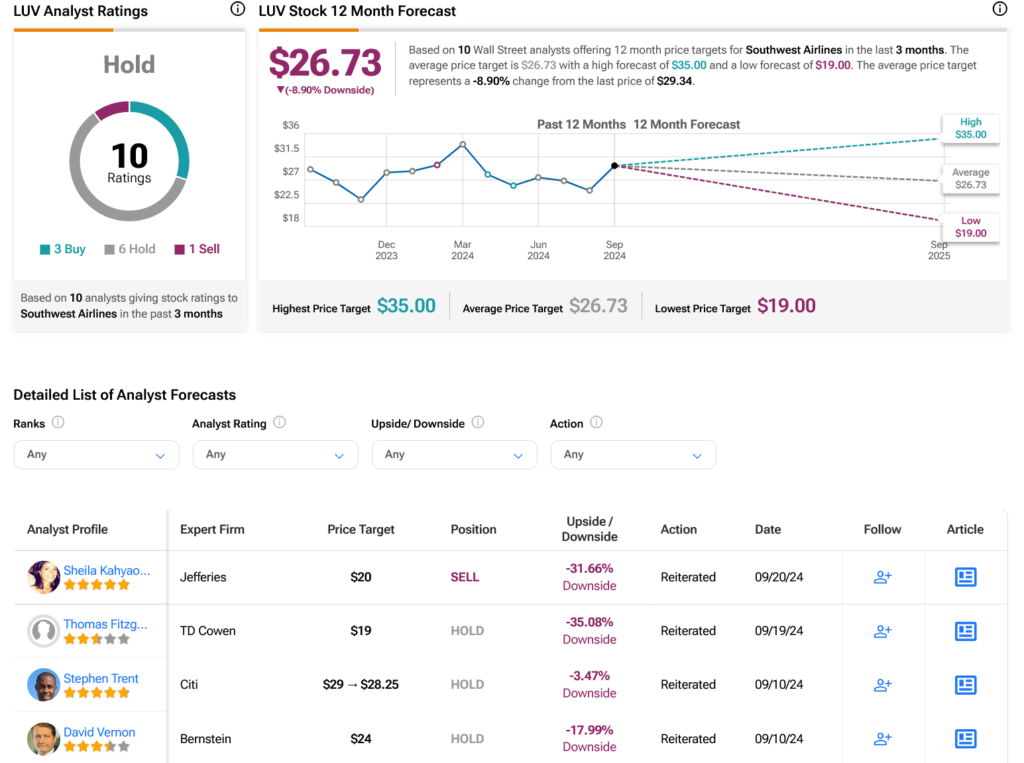

As for Wall Street, analysts have a consensus recommendation for LUV stock based on three buy recommendations, six hold recommendations, and one sell recommendation over the past three months, as shown in the chart below. After an 8.99% increase in the share price over the past year, LUV’s average price target of $26.73 per share represents 8.9% downside risk.

View more LUV analyst ratings

notice