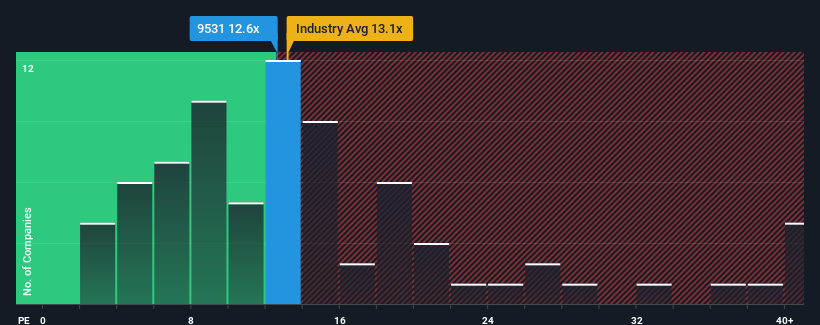

There are not many who think Tokyo Gas Co., Ltd. (TSE:9531) price-to-earnings (or “P/E”) ratio of 12.6 is worth noting when the median P/E ratio in Japan is similarly high, at around 13. While this may not be surprising, if the P/E ratio is not justified, investors could miss a potential opportunity or ignore an impending disappointment.

Tokyo Gas Ltd. could be doing better as its earnings have been declining recently while most other companies have been reporting positive earnings growth. It could be that many are expecting the weak earnings performance to improve positively, which has prevented a decline in the P/E ratio. If not, existing shareholders could be a little nervous about the profitability of the share price.

Check out our latest analysis for Tokyo GasLtd

If you want to know what analysts are predicting for the future, you should check out our free Report on Tokyo Gas Ltd.

Is there growth for Tokyo Gas Ltd.?

A P/E ratio like that of Tokyo Gas Ltd. is only safe if the company’s growth is closely in line with the market.

Looking back, the last year has brought a frustrating 63% decline in the company’s earnings. Yet, despite the unsatisfactory short-term performance, the last three-year period has brought an excellent overall increase in earnings per share of 156%. Although it has been a bumpy ride, it is still fair to say that the recent earnings growth has been more than adequate for the company.

As for the outlook, the company is expected to grow 2.2% per year over the next three years, according to the estimates of the five analysts who cover the company. The rest of the market is forecast to grow 9.3% per year, which is much more attractive.

With that in mind, we find it interesting that Tokyo Gas Ltd. is trading at a P/E ratio that is fairly similar to the market. Apparently, many investors in the company are less pessimistic than analysts indicate and are not willing to offload their shares at this time. Maintaining these prices will be difficult, as this earnings growth will likely weigh on the shares at some point.

The conclusion on the P/E ratio of Tokyo Gas Ltd.

It is argued that the price-to-earnings ratio is not a good measure of value in certain industries, but can be a meaningful indicator of business sentiment.

Our study of analyst forecasts for Tokyo Gas Ltd. found that the weaker earnings outlook is not impacting the P/E as much as we would have expected. At the moment, we are unhappy with the P/E as the forecast future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it is difficult to accept these prices as reasonable.

We don’t want to spoil the fun too much, but we also found 3 warning signs for Tokyo Gas Ltd that you need to consider.

If you are interested in P/E ratiosyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we are here to simplify it.

Find out if Tokyo GasLtd could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.