Foshan Haitian Flavouring and Food (SHSE:603288) has had a rough three months, with its share price down 8.2%. However, if you look closely, you’ll see that its key financial indicators are looking pretty decent, which could mean that the stock could potentially rise in the long term, as markets usually reward more stable long-term fundamentals. In this article, we’ve focused on Foshan Haitian Flavouring and Food’s return on equity.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investments it receives from its shareholders. In simpler terms, it measures the profitability of a company relative to shareholders’ equity.

Check out our latest analysis for Foshan Haitian Flavoring and Food

How is ROE calculated?

The Formula for return on equity Is:

Return on equity = Net profit (from continuing operations) ÷ Equity

Based on the above formula, the ROE for Foshan Haitian Flavoring and Food is:

19% = CNY 5.8 billion ÷ CNY 31 billion (based on the last twelve months to March 2024).

The “return” is the annual profit. This means that for every Chinese yen of equity, the company generated a profit of 0.19 Chinese yen.

Why is return on equity (ROE) important for earnings growth?

We have already established that return on equity (ROE) serves as an efficient measure of a company’s future earnings. Based on the proportion of profits the company reinvests or “retains,” we can then assess a company’s future ability to generate profits. Generally speaking, companies with high return on equity and earnings retention will have a higher growth rate than companies that do not have these characteristics, all other things being equal.

A comparison of Foshan Haitian Flavoring and Food’s earnings growth and return on equity

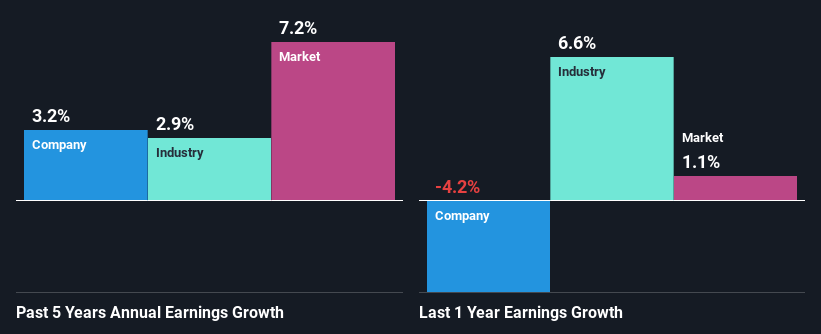

First of all, Foshan Haitian Flavouring and Food’s return on equity looks acceptable. Especially when compared to the industry average of 8.2%, the company’s return on equity looks pretty impressive. However, for some reason, the higher returns are not reflected in Foshan Haitian Flavouring and Food’s meager five-year average net income growth of 3.2%. This is interesting because the high returns should mean that the company is capable of delivering high growth, but for some reason it hasn’t been able to. Such a scenario is likely to occur when a company pays out a large portion of its profits as dividends or faces competitive pressures.

Next, we compared Foshan Haitian Flavouring and Food’s net profit growth with the industry and found that the company’s reported growth is in line with the industry average growth rate of 2.9% over the past few years.

Earnings growth is an important factor in stock valuation. Next, investors need to determine whether the expected earnings growth, or lack thereof, is already factored into the stock price. This will help them gauge whether the stock is heading for clear waters or whether it is drifting into murky waters. Is 603288 fairly valued? This infographic on the company’s intrinsic value has everything you need to know.

Does Foshan Haitian Flavoring and Food reinvest its profits efficiently?

The high median payout ratio of 51% over the last three years (meaning the company only retains 49% of its earnings) for Foshan Haitian Flavouring and Food suggests that the company’s earnings growth has been lower due to it paying out a large portion of its earnings.

In addition, Foshan Haitian Flavouring and Food has been paying dividends for at least ten years, which suggests that management must have recognized that shareholders prefer dividends over earnings growth. Our latest analyst data shows that the company’s future payout ratio is expected to be around 56% over the next three years. Therefore, Foshan Haitian Flavouring and Food’s return on equity is also not expected to fluctuate significantly, which we concluded from the analyst estimate of 20% for future return on equity.

Diploma

Overall, we think that Foshan Haitian Flavouring and Food does have some positive factors to consider. The company has been growing its earnings at a moderate rate, as mentioned above. Nevertheless, the high return on equity could have been even more beneficial to investors if the company had reinvested a larger portion of its profits. As mentioned above, the current reinvestment rate seems to be quite low. However, when looking at the current analyst estimates, we found that the company’s earnings are expected to gain momentum. You can find more information on the company’s future earnings growth forecasts here free Read the company’s analyst forecasts report to learn more.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.