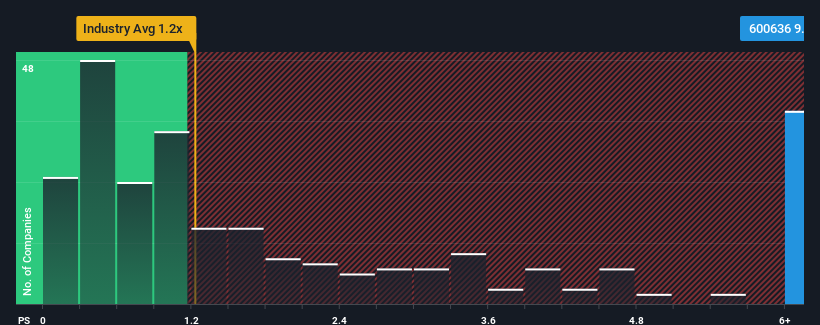

When nearly half of the companies in the consumer services industry in China have a price-to-sales ratio (or “P/S”) of less than 3.1x, you may consider China Reform Culture Holdings Co., Ltd. (SHSE:600636) is a stock to avoid at all costs with its 9.2x price-to-earnings ratio. However, it is not advisable to simply take the price-to-earnings ratio at face value, as there may be an explanation as to why it is so high.

Check out our latest analysis for China Reform Culture Holdings

How has China Reform Culture Holdings performed recently?

For example, consider that China Reform Culture Holdings’ financial performance has been poor recently as revenue has been declining. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, keeping the P/S ratio high. However, if it doesn’t, investors could fall into the trap of overpaying for the stock.

We don’t have analyst forecasts, but you can see how recent trends are positioning the company for the future by checking out our free China Reform Culture Holdings earnings, revenue and cash flow report.

What do the sales growth metrics tell us about the high P/S?

China Reform Culture Holdings’ price-to-sales ratio would be typical of a company expected to deliver very strong growth and, more importantly, significantly outperform the industry.

When we reviewed last year’s financials, we were disappointed to see the company’s revenues decline by 28%. This means that revenues have also declined over the long term, with revenues declining by 47% overall over the last three years. Accordingly, shareholders were sobered about medium-term revenue growth rates.

When compared to the industry, which is forecast to grow by 32 percent over the next twelve months, the company’s downward momentum based on its latest medium-term sales figures paints a sobering picture.

With this in mind, it is alarming that China Reform Culture Holdings’ P/S is higher than most other companies. Clearly, many investors in the company are much more optimistic than its recent history would suggest, and are not willing to dump their shares at any price. Only the bravest would assume that these prices are sustainable, as a continuation of recent revenue trends will likely ultimately weigh heavily on the share price.

The most important things to take away

In our view, the price-to-sales ratio does not serve primarily as a valuation tool, but rather helps to assess current investor sentiment and future expectations.

Our research into China Reform Culture Holdings found that declining revenues over the medium term do not translate into as low a P/S ratio as we expected, as the industry is expected to grow. At the moment, we are not happy with the high P/S ratio, as this revenue trend is most likely not going to sustain such a positive sentiment for long. If recent medium-term revenue trends continue, shareholders’ investments will be put at significant risk and potential investors will risk paying an inflated premium.

There are also other important risk factors to consider before investing and we have found 1 warning signal for China Reform Culture Holdings that you should know.

Naturally, Profitable companies with a history of strong earnings growth are generally safer bets. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.