(Bloomberg) — According to Kevin Gallagher, chief executive of Santos Ltd., demand for natural gas will remain strong despite government and corporate efforts to reduce emissions to zero by mid-century.

Gallagher is under pressure to deliver on its ambitious strategy to increase production by more than 50% by the end of the decade and establish Australia’s second-largest fossil fuel producer as a major international energy supplier. The company said earlier on Wednesday its major Barossa liquefied natural gas project was almost 80% complete and expected to produce first gas next year.

“Santos is developing a product that the world needs,” Gallagher, chief executive of the Adelaide-based company, said in an interview with Bloomberg Television. “We expect demand for gas – particularly LNG – to remain very strong beyond 2050.”

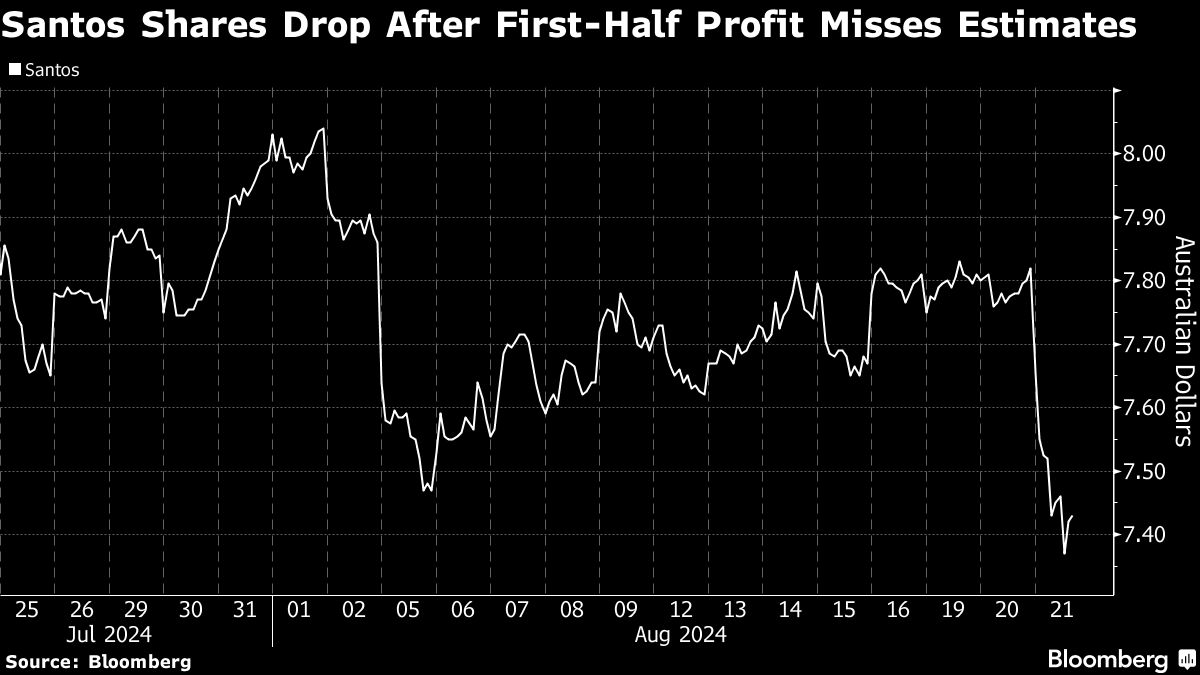

The company’s shares fell as much as 5.8 percent on Wednesday, the biggest drop in more than six months. The company had previously reported an 18 percent year-on-year decline in adjusted profit in the first half of the year, missing expectations. Production fell by two percent.

Still, Gallagher’s optimistic outlook helped convince the board to declare an interim dividend of 13 cents per share, higher than in the same period last year. The producer is emerging from a capital-intensive period next year, which should lead to more free cash flow due to stronger production, he said.

Santos has rebuffed a takeover attempt by larger Australian rival Woodside Energy Ltd. in late 2023, while Saudi Aramco and Abu Dhabi National Oil Co. both considered a takeover this year. Gallagher told an analyst conference that Santos’ “world-class LNG portfolio” would be attractive to other investors.

“They know the phone numbers, so if they want to come and talk to us, they know how to reach us,” he said.

(Updated with CEO comments in third paragraph.)

©2024 Bloomberg L.P.