Nippon Gas Co., Ltd. (TSE:8174) will increase its dividend on November 18 from last year’s payout to 46.25 yen. This brings the dividend yield to 3.9%, which is above the industry average.

Check out our latest analysis for Nippon Gas

Nippon Gas pays out more than it earns

While an impressive dividend yield is good, it doesn’t matter so much if the payments can’t be sustained. Before this announcement, Nippon Gas was paying out 88% of earnings but a comparatively low 75% of free cash flow, leaving plenty of money to reinvest in the business.

Earnings per share are expected to grow 12.5% next year. If the dividend stays at its current rate, the payout ratio could be 105% in 12 months, which is a bit high and could put pressure on the balance sheet.

Dividend volatility

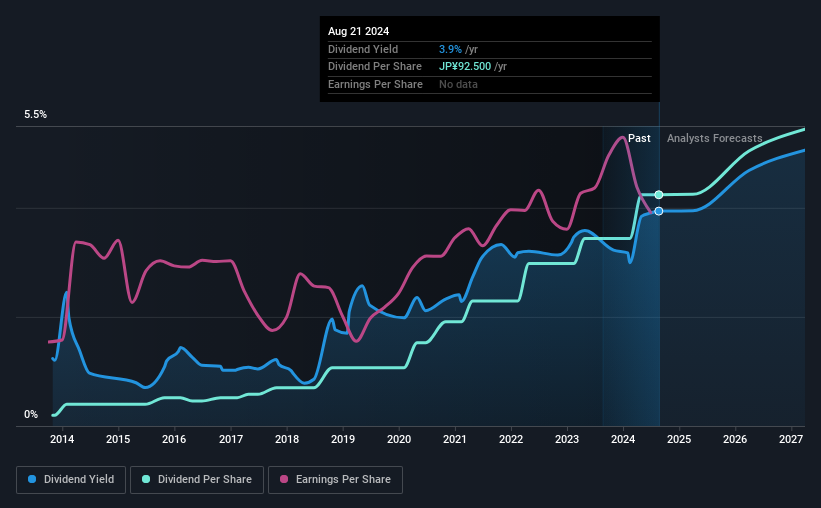

The company has a long dividend history, but it doesn’t look good due to past cuts. Since 2014, the dividend has increased from a total of ¥4.33 per year to ¥92.50 per year. This represents a compound annual growth rate (CAGR) of approximately 36% per year over that period. Despite rapid dividend growth in recent years, payments have also declined in the past, which makes us cautious.

Dividend growth could be limited

With a relatively unstable dividend, it’s even more important to see if earnings per share are growing. Nippon Gas has impressed us with earnings growth of 15% per year over the past five years. Earnings per share have grown at a reasonable pace, but with the majority of profits being distributed to shareholders, growth prospects may be more limited going forward.

Our thoughts on Nippon Gas’ dividend

In summary, while it’s always good to see a dividend increase, we don’t think Nippon Gas’s payments are completely reliable. Payments haven’t been particularly stable and we don’t see much growth potential, but since the dividend is well covered by cash flows, it could prove reliable in the short term. Overall, we don’t think this company has what it takes to be a good dividend stock.

Investors generally prefer companies with a consistent, stable dividend policy over those with irregular dividend policies. Although dividend payments are important, they are not the only factors our readers should consider when evaluating a company. For example, we have selected the following companies: 1 warning sign for Nippon Gas investors should know before investing capital in this stock. If you are a dividend investor, you may also want to take a look at our curated list of high dividend stocks.

Valuation is complex, but we are here to simplify it.

Find out if Nippon Gas could be undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.