In this story

Vice President Kamala Harris unveiled plans to combat the surge in homeownership on Wall Street as part of a series of economic proposals announced Friday.

The Democratic presidential candidate is targeting investors who are buying up large numbers of homes and selling them at higher prices. This growing trend is making the housing and rental market more expensive for Americans, according to the Harris campaign team.

Harris said that within her first 100 days in office, she would call on Congress to “Law against Predatory Investing”, a bill introduced in July 2023 by Ohio Senator Sherrod Brown that would eliminate tax benefits for large investors who purchase large quantities of single-family homes for rental purposes.

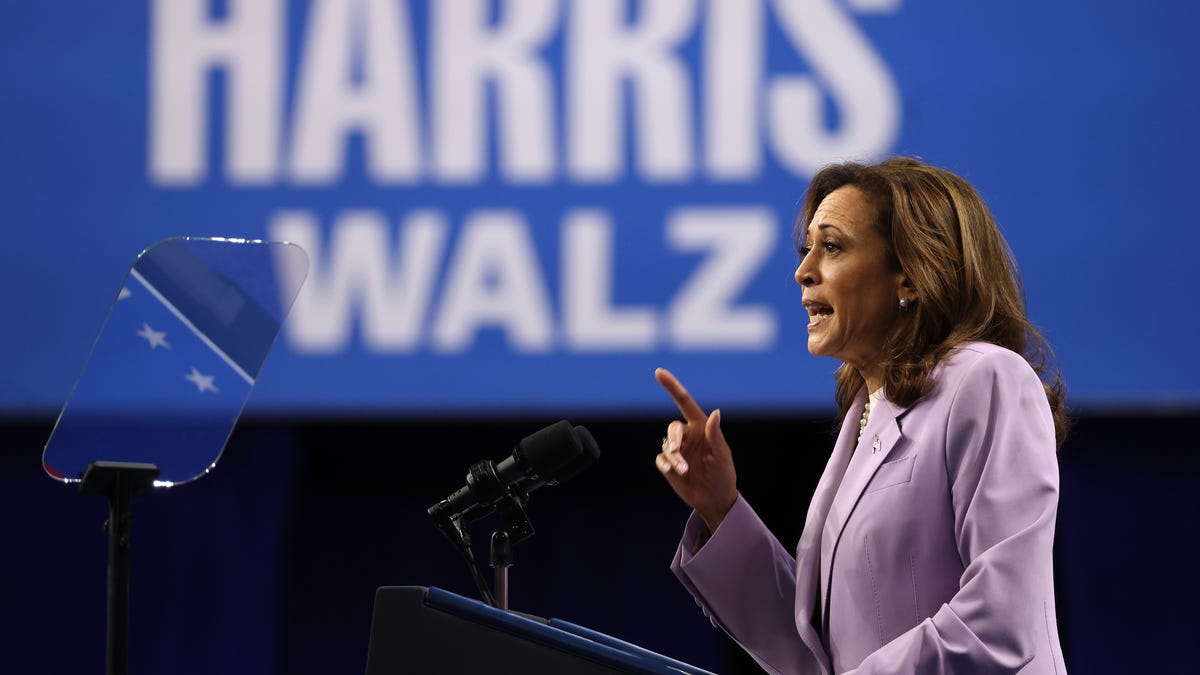

“Some corporate landlords buy dozens, if not hundreds, of houses and apartments and then rent them out at extremely high prices,” says Harris. said at a campaign rally on Friday in Raleigh, North Carolina. “And it may then become impossible for normal people to buy a home or even rent one.”

Investors bought a quarter of single-family homes sold by the end of 2022. While high interest rates and low supply have helped slow some of that activity, Wall Street has stayed in the zone. That’s especially true for more affordable housing: According to Redfin, real estate investors bought 26% of the most affordable homes sold in the fourth quarter of 2023. (RDFN) Data.

If these trends continue, MetLife Investment Management will (MET) estimates that institutional investors could control 40% of single-family rental homes in the United States by 2030.

For years, lawmakers have tried to limit Wall Street’s influence on the real estate market. A group of congressmen led by California Democrat Ro Khanna drafted Stop Wall Street Landlords Act of 2022 to prevent institutional investment in real estate. Khanna said The law, which would impose a tax on existing and future purchases of single-family homes, “will help level the playing field and put an end to rent gouging in America.”

“Wall Street’s financialization of the housing market exacerbates corporate profiteering and anti-competitive practices and makes it harder for Americans to afford housing or own a home,” he said.

The housing market is increasingly unaffordableespecially for First-time home buyers. The median sales price of a home rose 4% year over year to $442,451 in June, according to the latest data from Redfin. The national average interest rate for a 30-year fixed-rate mortgage was 6.9%. Renters don’t have it much easier, as the median rent for all property types comes to $2,120$25 less than last year, but still well above pre-pandemic levels.

Invitation Houses (INVH) and AMH (AMH) are two of the largest publicly traded real estate investors in the country. Invitation Homes, originally founded by private equity giant Blackstone Group (BX)owns over 80,000 apartments; AMH has a portfolio of more than 53,000 single-family homes in 22 states. Blackstone, which backs a number of other private real estate investors, owns approximately 63,000 single-family homes in the USA

Kurt Carlton, president and co-founder of real estate investment marketplace New Western, said, “It is unlikely that the Stop Predatory Investing Act, if passed, would have a tangible positive impact on homeowners.”

“While there have been brief periods where Wall Street investors have purchased a significant share of homes, these have primarily been short-term trends,” Carlton said. He added that “the vast majority of these purchases are being made by small, local investors who typically own fewer than five homes and generally have a disproportionately positive impact on homeownership and affordability.”

The role of small, local real estate investors is often misunderstood and, according to Carlton, would help solve some of the problems Harris wants to address.

“Most local real estate investors focus on identifying vacant, undesirable properties and converting them into livable housing units,” he said. “In doing so, they play a critical role in addressing housing shortages and improving communities.”

Opponents, however, argue that these investors are exacerbating the housing shortage in the United States, which has now reached 4 and 7 million householdsAnd new construction is not keeping pace with demand: The total number of housing starts in the USA Decrease of 6.8% from a year earlier to a rate of 1.2 million in July – the largest decline since April 2020, the start of COVID lockdowns, according to Census Bureau data released Friday. This was due to a 14% year-over-year decline in single-family housing starts and a 21.8% decline in multifamily housing starts.

This slowdown “will constrain supply in a market that is already struggling with low inventories,” said Jeffrey Roach, chief economist at Charlotte-based LPL Financial. (LPLA).

Harris plans to order the construction of three million new housing units to ease the supply shortage within four years, her campaign said Friday. As part of that effort, Harris plans to introduce a tax incentive for builders who construct first-time homes sold to first-time buyers, expand existing tax incentives for builders of rental housing and propose a new $40 billion innovation fund to boost housing construction.

On Tuesday, the Ministry of Housing and Urban Development announced 100 million US dollars in funding to reduce barriers to the construction of affordable housing as part of the “Pathways to Removing Obstacles to Housing” programme.

As part of her first 100-day program, Harris also proposed introducing a $25,000 down payment for first-time homebuyers who have paid their rent on time for two years, and “more generous assistance” for first-generation homeowners.

Read more

Kamala Harris’ plan to lower grocery bills includes a ban on corporate “price gouging”

Kamala Harris’ plan to keep prescription drug prices low includes a $2,000 cap on deductibles.