The latest quarterly update from Home Depot (NYSE: HD) delivered several mixed signals. While the home improvement giant reported better-than-expected financial results, management’s weak guidance overshadowed the report. The stock has fallen about 8% since its 52-week high, highlighting ongoing uncertainties in consumer spending and the company’s vulnerability to volatile conditions in the housing market.

Are there enough positives in the outlook to outweigh the near-term macro headwinds? Let’s examine whether the recent sell-off presents a good opportunity to buy Home Depot shares for your portfolio.

A cautious outlook from management

Home Depot has demonstrated resilience over the past few years, successfully maintaining profitability in a changing post-pandemic environment. This theme will be put to the test in early 2024.

In the second quarter, Home Depot reported earnings per share (EPS) of $4.67, $0.12 above Wall Street’s average estimate and about in line with the year-ago quarter. Revenue of $43.2 billion rose 1% year over year, also above consensus.

Those headline numbers are positive, but context is also important here. In this case, Home Depot’s acquisition of SRS Distributors in March boosted total second-quarter sales by $1.3 billion, while comparable U.S. sales fell a disappointing 3.6%. That includes a decline in in-store traffic and lower average selling prices.

The company has its margins well under control through cost-saving measures, but what it cannot control is a more difficult operating environment. That was the message from CEO Ted Decker, who described weaker demand as requiring some caution. In the second-quarter conference call, he said:

Higher interest rates and greater macroeconomic uncertainty have put downward pressure on consumer demand generally, resulting in lower spending on home improvement projects. Looking at performance through the first six months of the year, as well as ongoing uncertainty about underlying consumer demand, we believe a more cautious revenue outlook is appropriate for the year.

Home Depot now expects comparable sales to decline 3 to 4 percent for the full year, down from a 1 percent decline forecast issued earlier this year. The company also expects adjusted earnings per share to decline 1 to 3 percent in 2024 compared to 2023, up from a previous forecast of a 1 percent increase.

Home Depot at a premium price

Quarterly turbulence aside, it’s fair to say Home Depot’s fundamentals remain solid, even as current trends hit a rough patch. One strong point has been its efforts to expand digital capabilities, as online sales have increased 4% over the past year.

The deal with SRS Distributors is also met with enthusiasm. Management is convinced that this deal can be a growth engine for the company and means expansion and diversification into the market for professional building materials.

Home Depot shares offer investors a 2.5% dividend yield that is well supported by underlying free cash flow. Ultimately, the positive argument for the stock is that the company will emerge stronger from the economic recovery, with potential Fed rate cuts through 2025 serving as a catalyst for a recovery in consumer home improvement demand.

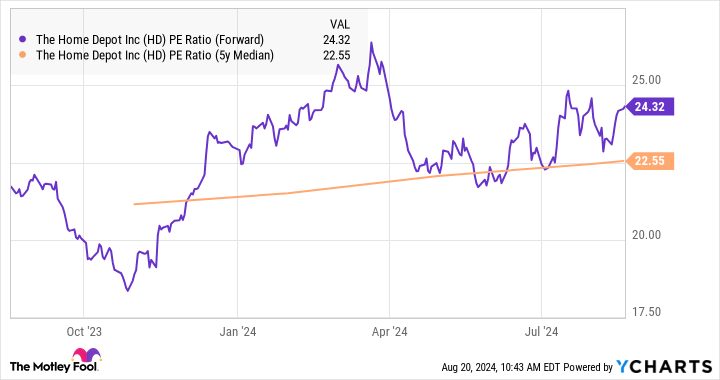

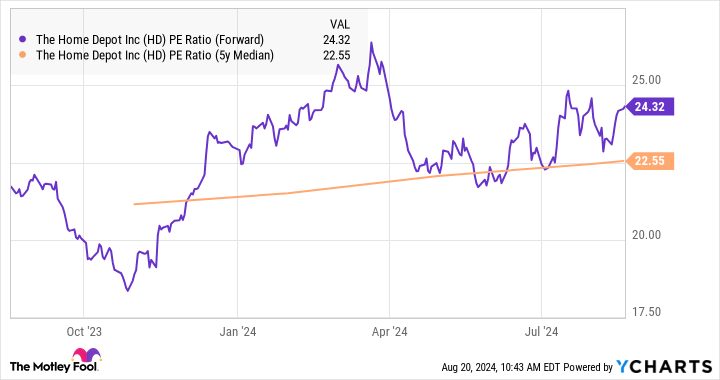

On the other hand, valuation deserves some attention. Home Depot stock trades at about 24 times management’s 2024 earnings forecast. Notably, this is above the company’s five-year average, which is closer to 23, meaning the stock is relatively expensive. That doesn’t mean shares need to be sold from here, but it does make it difficult to see any upside in the short term.

It seems that the market is giving the company the benefit of the doubt and is already anticipating a recovery despite the ongoing uncertainties. The main risk is that conditions deteriorate further, requiring a downward reassessment of earnings performance.

HD PE Ratio (Forward) data from YCharts.

Decision time for Home Depot shares

I believe Home Depot stock deserves a hold rating for current shareholders, while investors considering adding to their positions are better off taking a wait-and-see approach. Until Home Depot shows signs that comparable sales, the key metric, can turn positive, I expect shares to remain volatile.

Should you invest $1,000 in Home Depot now?

Before you buy Home Depot stock, consider the following:

The Motley Fool Stock Advisor The analyst team has just published what they believe to be The 10 best stocks for investors to buy now…and Home Depot wasn’t one of them. The 10 stocks that made the cut could deliver huge returns in the years to come.

Consider when NVIDIA created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, You would have $792,725!*

Stock Advisor offers investors an easy-to-understand plan for success, including instructions on how to build a portfolio, regular updates from analysts, and two new stock recommendations per month. The Stock Advisor Service has more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 22, 2024

Dan Victor does not own any stocks mentioned. The Motley Fool owns and recommends Home Depot. The Motley Fool has a disclosure policy.

Is Home Depot Stock a Buy Now After Earnings? was originally published by The Motley Fool