Key findings

CEO Gabi Shatoi has done a good job and achieved a relatively good performance in Holmes Place International Ltd (TLV:HLMS) recently. This is something shareholders will keep in mind as they vote on corporate decisions such as executive compensation at the upcoming annual general meeting on August 21. However, some shareholders will continue to be wary of overpaying the CEO.

Check out our latest analysis for Holmes Place International

Comparison of CEO compensation of Holmes Place International Ltd. with industry compensation

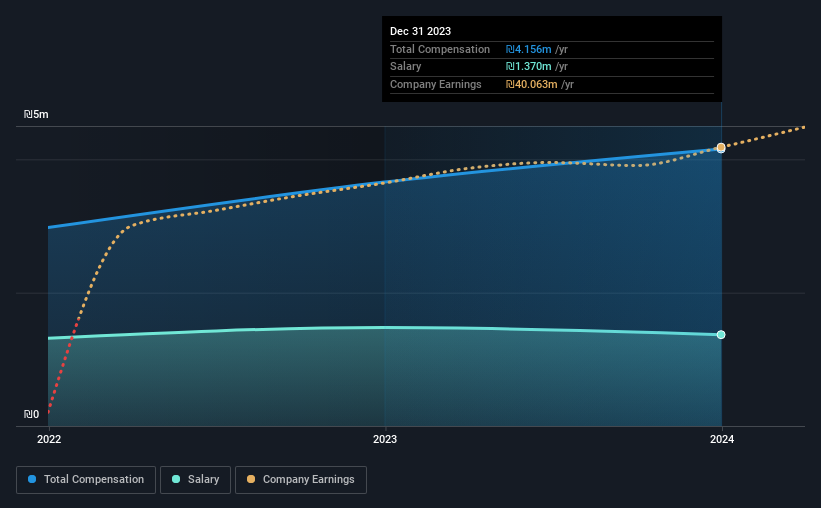

According to our data, Holmes Place International Ltd has a market capitalization of ₪421m and the CEO’s total annual compensation was reported at ₪4.2m for the year ending December 2023. That’s an increase of 14% year over year. We think total compensation is more important, but our data shows that the CEO’s salary is lower at ₪1.4m.

When comparing similarly sized companies in the Israeli hotel industry with a market capitalization of less than ₪741 million, we found that the median total CEO compensation was ₪349,000. From this, we can conclude that Gabi Shatoi receives higher compensation than the industry average.

| component | 2023 | 2022 | Share (2023) |

| Salary | 1.4 million € | 1.5 million | 33% |

| Other | 2.8 million € | 2.2 million € | 67% |

| Total compensation | 4.2 million € | 3.7 million € | 100% |

Across industries, salary accounted for about 47% of total compensation at all the companies we analyzed, while other compensation made up 53% of the pie. Interestingly, Holmes Place International allocates a smaller share of compensation to salary compared to the industry as a whole. It’s important to note that a bias toward non-salary compensation suggests that total compensation is tied to company performance.

A look at the growth figures of Holmes Place International Ltd.

Holmes Place International Ltd has been able to increase its earnings per share (EPS) by 108% per year over the last three years. Last year, revenue increased by 7.1%.

Overall, this is a positive result for shareholders, showing that the company has been improving over the past few years. It’s nice to see revenues growing as this comes with healthy business conditions. While we don’t have analyst forecasts for the company, shareholders may want to check this detailed historical graph of earnings, revenue and cash flow.

Was Holmes Place International Ltd a good investment?

We believe that the total return of 41% over three years would satisfy most Holmes Place International Ltd. shareholders. Therefore, some may believe that the CEO should be earning more than is typical for companies of a similar size.

Conclusion …

Given the company’s strong performance, few, if any, shareholders will be concerned about the CEO’s compensation at the upcoming AGM. However, any decision to increase the CEO’s salary could face some objections from shareholders, as the CEO already earns more than the industry average.

CEO compensation is an important aspect to keep an eye on, but investors should also look for other aspects related to company performance, so we dug a little deeper and found this: 1 warning sign for Holmes Place International that you should know before investing.

Important NOTE: Holmes Place International is an exciting stock, but we understand that investors may be looking for an unencumbered balance sheet and high yields. Perhaps you will find something better in this list of interesting companies with high return on equity and low debt.

Valuation is complex, but we are here to simplify it.

Find out if Holmes Place International is undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.