Mark Hahn, the Chief Financial Officer of Verona Pharma PLC (NASDAQ:VRNA), conducted a significant transaction on August 13, 2024, in which the insider sold 400,000 shares of the company’s stock. The sale was documented in a recent SEC filing. Following this transaction, the insider now owns 14,939,688 shares of Verona Pharma PLC.

Verona Pharma PLC is a biopharmaceutical company focused on the development and commercialization of innovative therapies to treat respiratory diseases. The company’s core products include treatments targeting chronic obstructive pulmonary disease, asthma and cystic fibrosis, among others.

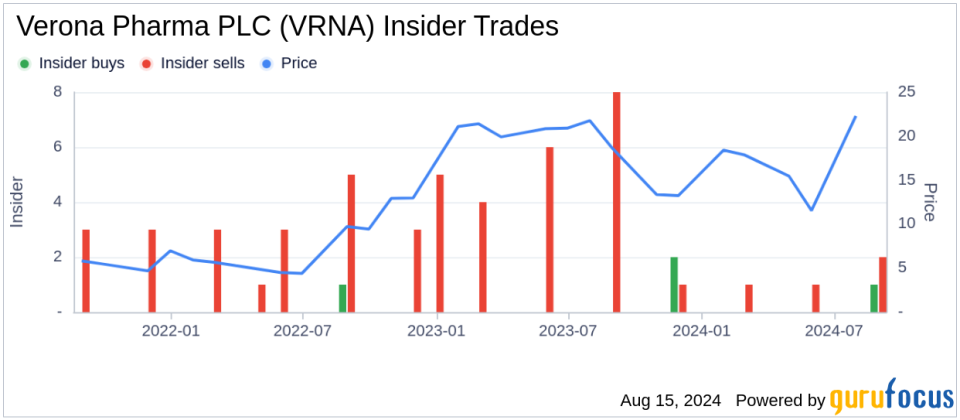

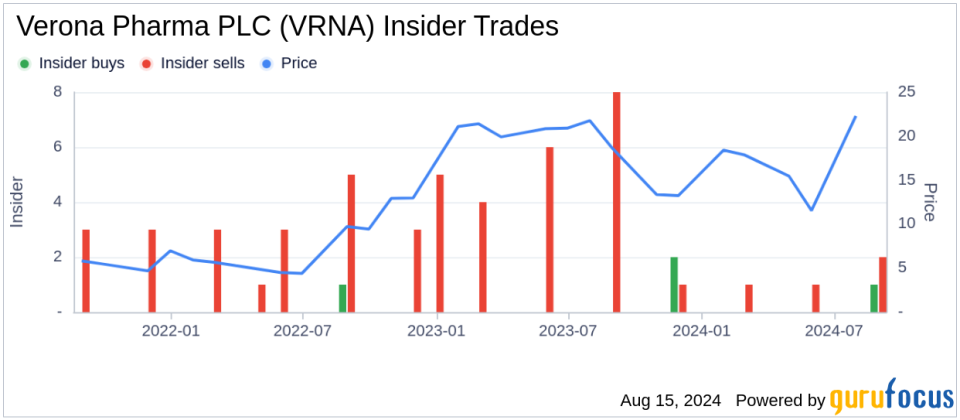

Over the past year, the insider transaction history at Verona Pharma PLC has shown a trend of 3 insider purchases and 5 insider sales. Mark Hahn’s recent sale is in line with this ongoing trend of there being more insider sales than purchases within the company.

On the day of the transaction, Verona Pharma PLC shares were trading at $3.2, giving the company a market capitalization of approximately $2.214 billion. This valuation reflects the market’s current view of the company, taking into account its recent performance and growth prospects.

To gain further insights into the company’s valuation metrics such as price-to-earnings ratio, price-to-sales ratio, price-to-book ratio and price-to-free cash flow, investors can consult the GF Value of the stock.

This insider sale may be of interest to current and prospective investors seeking to understand recent insider activity and its impact on their investment decisions at Verona Pharma PLC.

This article created by GuruFocus is intended to provide general insights and does not constitute tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment advice. It does not contain a recommendation to buy or sell any stock and does not take into account any individual investment objectives or financial circumstances. Our goal is to provide long-term, fundamental, data-driven analysis. Note that our analysis may not include the most recent, price-sensitive company announcements or qualitative information. GuruFocus does not hold a position in any stocks mentioned here.

This article first appeared on GuruFocus.