The Board of Japan Airport Terminal Co., Ltd. (TSE:9706) has announced that it will declare a dividend of 31.00 yen per share on December 9. Although the dividend was increased, the yield is still quite low at just 1.2%.

Check out our latest analysis of Japan Airport Terminal

Japan Airport Terminal’s dividend is well covered by earnings

Even a low dividend yield can be attractive if it is sustained for years. However, prior to this announcement, Japan Airport Terminal’s dividend was comfortably covered by cash flow and earnings. This means that the majority of profits are retained to grow the business.

Earnings per share are expected to decline by 0.9% over the next 12 months. Assuming the dividend follows recent trends, we believe the payout ratio could be as high as 34%. We are quite happy with that and think it is doable on an earnings basis.

Dividend volatility

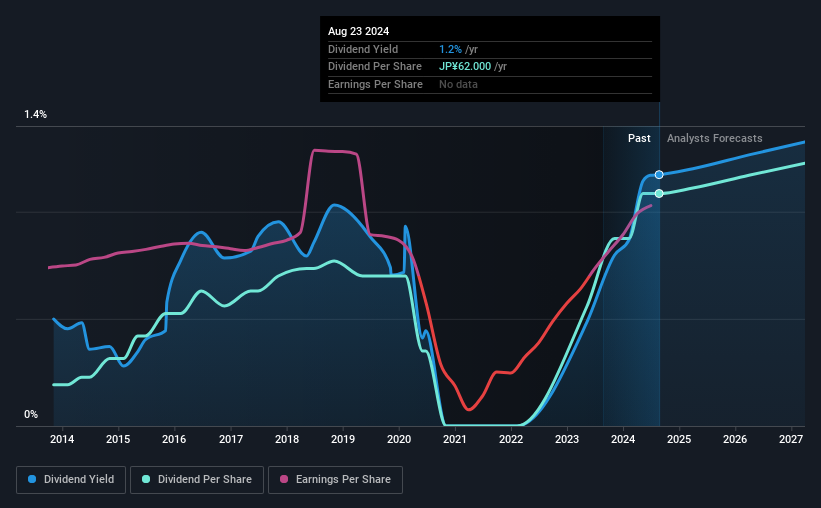

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has grown from an annual total of ¥11.00 in 2014 to the most recent annual total payout of ¥62.00. This represents a compound annual growth rate (CAGR) of approximately 19% per year over that period. It’s great to see strong growth in dividend payments, but cuts are concerning as they could be a sign that the payout policy is too ambitious.

The dividend is likely to increase

Rising earnings per share could be a mitigating factor when considering past dividend fluctuations. It’s encouraging to see that Japan Airport Terminal has been able to grow its earnings per share at 11% per year over the past five years. Japan Airport Terminal definitely has the potential to grow its dividend in the future, given that earnings are on an upward trend and the payout ratio is low.

Japan Airport Terminal looks like a great dividend stock

In summary, a dividend increase is always positive, and we’re particularly pleased with its overall sustainability. Distributions are easily covered by earnings, and there’s plenty of cash being generated too. We should point out that earnings are expected to fall over the next 12 months, which isn’t a problem if it doesn’t become a trend, but could cause turbulence next year. All in all, this ticks many of the boxes we look for when choosing a dividend stock.

It is important to note that companies with a consistent dividend policy generate more confidence among investors than those with an irregular one. At the same time, there are other factors that our readers should consider before putting capital into a stock. To this end, Japan Airport Terminal 2 warning signs (and 1 that is a little concerning) that we think you should know about. If you are a dividend investor, you may also want to take a look at our curated list of high dividend stocks.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.