Finding a company that has the potential to grow significantly is not easy, but it is possible if we look at some key financial metrics. First, we want to find a proven return on the capital employed (ROCE), which is increasing, and secondly a growing base of the capital employed. Simply put, these types of companies are compound interest machines, meaning that they continually reinvest their profits at ever-increasing returns. However, after a quick look at the numbers, we do not believe that China Oil and Gas Group (HKG:603) has the potential to be a multi-bagger in the future, but let’s take a look at why that might be the case.

Understanding Return on Capital Employed (ROCE)

For those who don’t know, ROCE is a measure of a company’s annual profit before tax (its return) relative to the capital employed in the company. The formula for this calculation at China Oil And Gas Group is:

Return on capital = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

0.085 = HK$1.0 billion ÷ (HK$21 billion – HK$8.6 billion) (Based on the last twelve months to December 2023).

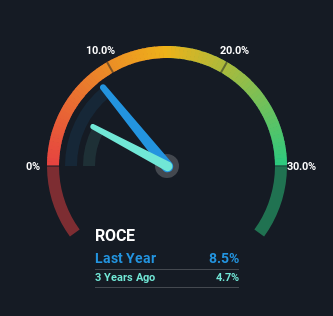

Therefore, China Oil And Gas Group has a ROCE of 8.5%. Even though this is in line with the industry average of 8.4%, it is still a low return in itself.

Check out our latest analysis for China Oil And Gas Group

While the past is not representative of the future, it can be useful to know a company’s historical performance, which is why we have this chart above. If you want to see how China Oil And Gas Group has performed in other metrics in the past, you can see that here. free Graph of China Oil And Gas Group’s past earnings, revenue and cash flow.

How are returns developing?

It has remained fairly stable for China Oil And Gas Group. Capital employed and return on capital have remained more or less the same over the past five years. This is not unusual when you look at a mature and stable company that does not reinvest its profits because it is probably past that stage of the economic cycle. So unless we see significant changes in terms of ROCE and additional investment at China Oil And Gas Group, we would not expect the company to become a multibagger.

While the change in ROCE trend may not be particularly eye-catching, it is interesting to note that current liabilities have actually increased over the past five years. This is interesting because if current liabilities had not increased to 41% of total assets, this reported ROCE would likely be lower than 8.5% because total capital employed would be higher. The 8.5% ROCE might be even lower if current liabilities were not 41% of total assets because the formula would show a larger base of total capital employed. Furthermore, this high level of current liabilities is not ideal because it means that the company’s suppliers (or short-term creditors) are effectively financing a large portion of the business.

Our assessment of China Oil And Gas Group’s ROCE

We can conclude that there are no notable changes in China Oil And Gas Group’s return on investment and trends. And investors seem to doubt that the trends will continue, as the stock has fallen 13% over the past five years. In any case, the stock does not have the characteristics of a multibagger described above, so if that is what you are looking for, we think you will have better luck elsewhere.

If you would like to explore the China Oil And Gas Group further, you may be interested in the 1 warning sign This is what our analysis has shown.

While China Oil And Gas Group may not have the highest returns right now, we have compiled a list of companies that currently have a return on equity of over 25%. Check it out free List here.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.