Legendary fund manager Li Lu (who was backed by Charlie Munger) once said, “The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.” When we think about how risky a company is, we always like to look at its use of debt, as excessive debt can lead to ruin. We can see that Centene Corporation (NYSE:CNC) does indeed use debt in its business. But is this debt a cause for concern for shareholders?

Why is debt risky?

Debt is a means of helping businesses grow, but if a company is unable to repay its debts to lenders, it is at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. More common (but still costly), however, is that a company must issue shares at bargain prices, permanently diluting shareholder ownership, just to shore up its balance sheet. Of course, many companies use debt to fund their growth without negative consequences. When considering how much debt a company has, you should first look at its cash and debt together.

Check out our latest analysis for Centene

How much debt does Centene have?

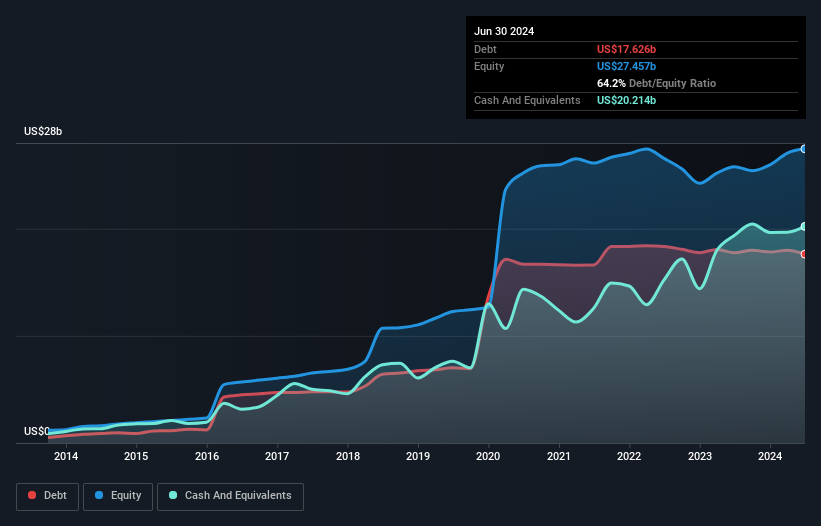

As you can see below, Centene had $17.6 billion in debt as of June 2024, which is about the same as last year. You can click on the chart to see more details. However, to balance it out, Centene also has $20.2 billion in cash, meaning the company has net cash of $2.59 billion.

How strong is Centene’s balance sheet?

If we take a closer look at the most recent balance sheet data, we can see that Centene had $32.7 billion in liabilities due within 12 months and $23.0 billion in accounts receivable due beyond that date. This included $20.2 billion in cash and $16.5 billion in accounts receivable due within 12 months. So total liabilities amount to $18.9 billion more than the combination of cash and short-term receivables.

This deficit isn’t too bad, as Centene is worth a whopping $41.1 billion and could therefore probably raise enough capital to shore up its balance sheet if it needed to. But it’s clear that we should look closely at whether the company can handle its debt without dilution. While it has notable liabilities, Centene also has more cash than debt, so we’re fairly confident that it can safely handle its debt.

Fortunately, Centene was able to grow its EBIT by 7.8% over the last year, which makes its debt load seem even more manageable. When analyzing debt, the balance sheet is clearly the best place to focus. But it is future earnings that will determine whether Centene can maintain a healthy balance sheet in the future. So if you want to know what the professionals think, you might be interested in this free report on analysts’ profit forecasts.

However, our final consideration is also important because a company can’t pay off its debt with accounting profits; it needs cold hard cash. While Centene has net cash on its balance sheet, it’s still worth taking a look at its ability to convert earnings before interest and tax (EBIT) into free cash flow to understand how quickly it’s building (or burning through) that cash pile. Over the last three years, Centene actually generated more free cash flow than EBIT. There’s nothing like incoming cash when it comes to staying in the good graces of lenders.

Summary

While Centene’s balance sheet isn’t particularly strong due to total liabilities, it’s clearly a positive that the company has net cash flow of US$2.59 billion. The cherry on top was that 115% of that EBIT was converted to free cash flow, generating US$2.3 billion. So we have no problem with Centene’s use of debt. Of course, we wouldn’t pass up the extra confidence we’d gain from knowing that Centene insiders have been buying shares: if you’re on the same wavelength, you can find out if insiders are buying by clicking this link.

If you are interested in investing in companies that can grow profits without the burden of debt, check this out free List of growing companies that have net cash on their balance sheet.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.